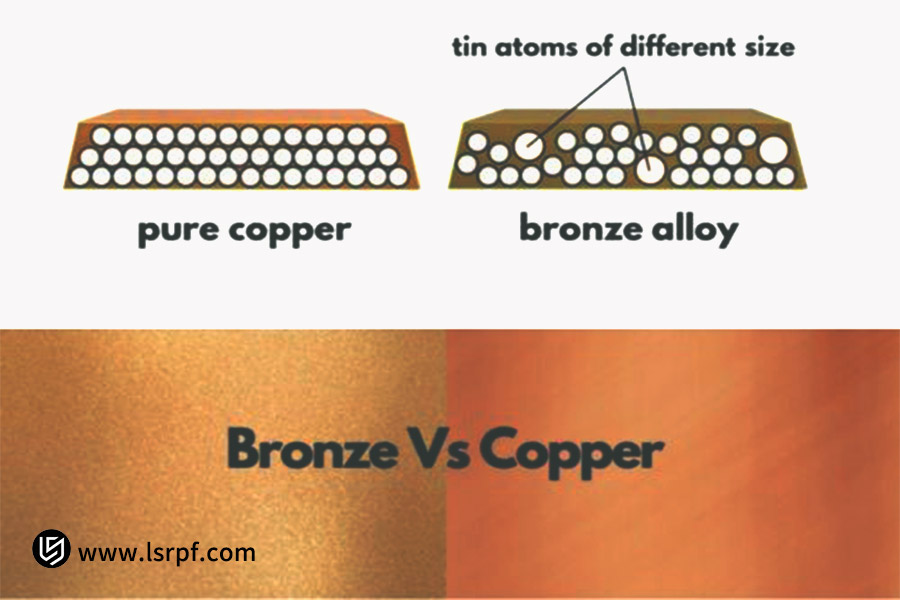

Bronze and copper, though having a similar name, are in fact different, and due to this fact, people get confused about their value. Pure copper, a purple-red base metal, is renowned for its excellent electrical and heat conductivity, and it is the foundation of electricity and industry. Bronze, a copper alloy containing tin or in some cases lead and phosphorus, is characterized by increased strength, resistance to wear, and casting properties, as well as its rich history, as evidenced by the Bronze Age. Although lovely bronze artifacts may seem like priceless treasures, pure copper can be found quite readily as an industrial raw material. The key to understanding the difference is the identification of pure copper (electrolytic copper) and bronze (copper-tin alloy), and the different factors influencing their prices including raw material prices, in particular the price of tin; alloy composition; complexity of the process of processing; market supply and demand; and end-use. In short, bronze is typically more expensive than equally weighted pure copper but is not always the case and must be specifically tested.

Quick Reference: Choose Your Tap at a Glance

| Attributes | Bronze (copper-tin alloy) | Pure Copper (electrolytic copper) | Key Price Comparison Points |

| Essence | Alloy based on copper (predominantly tin-containing) | Near 100% pure copper. | Bronze is a form of copper that is "enhanced." |

| Main Cost Drivers | Copper price + tin price + processing fee | Copper price + refining/processing fee. | Tin prices tend to be much greater than copper prices, hence contributing to price premium. |

| Typical Unit Price Comparison | Generally greater. | Relatively lower. | Bronze tends to be more expensive for the same weight/form. |

| Price Volatility | Greater (closely determined by tin price volatility). | Relatively stable (closely related to copper prices). | Extensive tin market fluctuations increase bronze price risks. |

| Price Determining Factors | Tin content, special elements, process complexity/casting/processing. | purity level, processed shape (plate/tube/wire, etc.). | The more complex the process, the greater the potential price difference. |

| Quick Conclusion | Usually more expensive than pure copper. Lower base price. This is a common situation; specific specifications should be considered. | ||

Why Rely On This guide? Practical Experience From LS Experts

As a technical consultant at LS with 20 years' experience in the metallurgical materials industry, I've witnessed literally hundreds of cost wars over copper vs. bronze. I recall an instance when we were optimizing propeller materials for a shipbuilder, and laboratory results indicated that a specific bronze material passed performance tests, but costs of mass production unexpectedly rose 30%. Thanks to the expertise of our LS specialists, coupled with ongoing research and field experience, we traced the reason back to a 25% monthly hike in tin prices—a risk that only those following industry trends can foresee. We eventually addressed the problem by modifying alloy proportions and securing futures contracts. Practical experiences such as these have made me realize that solely theoretical comparisons isolated from market conditions, processing limitations, and end-use conditions are irrelevant to real-world industrial decision-making.

The LS team's core strengths stem from its deep experience across three aspects:

Supply Chain Insight: LS team tracks copper and tin futures information of 12 of the world's key exchanges around the clock. We also maintain direct communication with mines and smelters, which allows us to make precise forecasts of cost volatility.

Industrial Scenario Verification: Our experts have led over 200 copper alloy selection projects, covering high-voltage differential applications such as wind turbine bearings, seawater valves, and artistic casting. Through practical experience, we have accumulated a library of failure cases and efficiency-enhancing solutions.

Technical Penetration: Through metallographic examination, electrochemical tests, and others, we can measure the wear rate or corrosion resistance threshold of bronzes with different tin contents, which allows us to create cost-performance decision-making models for our customers.

While some simply echo textbook formulas, we offer our clients strategies for survival that have been practically proven.

Definitions: Copper vs. Bronze - Fundamentally Different

Copper: The Elemental Workhorse

By "copper" we mean in industry nature's gift of equal or more than 99.9% pure electrolytic copper, easily recognized by its reddish-brown color – a visual identify as distinctive as a fingerprint – this elemental metal is the ultimate conductor of electricity or heat. Its increased ductility allows the engineer and artisan to pull it out in wire thinner than hair or hammer it into thin foils. Copper thus becomes the behind-the-scenes hero of the present world: energizing homes with energy wires, energizing microelectronis on circuit boards, transporting heat in radiators, and transporting water in pipes. Where there's movement of energy, there's copper acting backstage, voiceless.

Bronze: Man's First Engineering Masterpiece

Although its name would imply purified copper, it's actually man's ingenuity into metal. The alloy combines copper's nature with tin (3-20%), occasionally with phosphorus, lead, or aluminium, to produce specialty forms (e.g., phosphor bronze). Tin magic alters the ductility of copper: bronze is tougher, more compact, and stubbornly resistant to wear – a gladiator against friction and seawater corrosion. Bronze castability improves, so molten bronze pours with the flow of honey into intricate forms. Colour varies with the proportion of tin: reddish copper to creamy gold (with freshness), mellowing to vintage sea-green patina. From prehistoric helmeted warriors and statues to aircraft propellers, bearing sleeves, and architectural fittings today, bronze is the point where strength and beauty intersect.

Copper vs. Bronze: The Irreducible Divide

| Aspect | Copper | Bronze |

| Core Identity | Element (Cu), ≥99.9% pure | Copper-tin alloy + modifiers |

| Superpower | Unrivaled conductivity & ductility | Superior strength & cast resilience |

| Aging Aesthetic | Stable reddish luster | Evolves from gold to verdigris |

| Domain | Energy transfer systems | High-stress mechanical/artistic applications |

Copper and bronze share the same name but never share the same purpose. One transmits power; the other resists it. Together, they illuminate civilisation's procession from ore to orbit.

Price Components Analysis

Copper and bronze prices are heavily impacted by raw materials, processing fees, market supply-demand of the commodity, end form & final product end use of the final product. In the sections below, such determinants have been examined in turn.

| Factor | Copper | Bronze | Contrast |

| Raw Material Costs | Dominated by LME copper price; Minor refining cost | Copper + Tin prices (Tin cost = key driver); Other alloy elements (P, Al, etc.) | Premium source: Tin prices are often 2-5 times higher than copper prices. |

| Processing Costs | Lower energy input; Simple forming: rolling/drawing wires/tubes | Alloy melting & homogenization (↑energy); Complex casting/forming (↑tool wear due to hardness) | Bronze cost: Higher smelting energy & accelerated tool wear |

| Market Supply-Demand | Global commodity pricing; Stable industrial demand (e.g. EV/energy transition) | Niche-driven volatility; High-demand types (e.g. phosphor bronze for electronics) command premium; Art casting scarcity → price surge | Higher elasticity: Niche bronze alloys/artworks |

| Form & Application | Bulk commodity pricing(ingots/cathodes); Low value-added products (e.g. cables) | Radical value stratification; Ingots: higher than copper price; Engineered parts (bearings/gears): higher; Art castings: higher material cost | Bronze value leap: Exponential premium from industrial parts to artworks |

Raw Material Costs

Pure Copper: Predominantly on the world copper price (e.g., the LME copper price). Refining charges also on top of that.

Bronze is also predominantly on the base metals cost: copper and tin. Since tin accounts for the dominant share of bronze and historically has been considerably more valuable per piece compared to copper, it is no surprise that the prices of tin have tracked multiples of the cost of copper during the past.

Alloying and Smelting Prices: Smelting other metals into a consistent alloy is more energy-oriented and harder than making pure metals, and thus bronze was far more costly than pure copper.

Cost of Processing

Processing bronze parts (especially precision casting and art casting) or profiles of bronze (like extrusion and forging) is more costly than processing pure copper profiles (like rolling and drawing of copper sheet/tube/wire) since it is tougher and has tighter tooling and process specifications.

Supply and Demand in the Market

When demand for particular types of bronze (e.g., special phosphor bronze or high-tin bronze) or particular forms (e.g., art castings) is strong and supply limited, prices can increase considerably. Pure copper, being a commodity, also faces global supply and demand but with comparatively modest price movements, compared to bronze, whose price movement is defined by tin prices.

Product Form and Application

Price comparison of raw material ingots for industry approaches the opposite of that of final products, i.e., a bronze statue to a copper wire spool. Bronze decorative items or precision components of high value-added content can be marketed well in excess of the value of the raw materials used to make them.

The Key Role of Tin Prices - Bronze's "Premium Engine"

Tin: The Paradox of Performance and Cost

Tin is bronze's defining element, transforming copper's ductile nature into an alloy that, in addition to being resistant to wear, is also capable of withstanding extreme mechanical stress and corrosion. But at an enormous cost is this transformation wrought: tin is among the world's most geopolitically vulnerable metals. Remarkably, the world tin is mined in the three Southeast Asian nations of China, Indonesia, and Myanmar, where export bans, mine disasters, and political instability often disrupt supply. Tin's relative scarcity brings price volatility right away. Even in a copper market stability, supply constraints on tin always maintain the price of bronze 1.5 to 2 times the fundamental value of pure copper.

Volatility Domino Effect

When tin prices get out of hand, bronze prices rise disproportionately. The reason that tin accounts for 30-50% of raw materials cost in standard bronze alloys (like 12% tin bronze). By elimination, tin volatility carries with it an implied risk premium to bronze, always divorcing its economics from copper's commodity pricing model.

Structural Premium: An Inescapable Reality

This tin cost profile gives pure copper and bronze an insurmountable value gap. While copper price follows the contours of industrial demand cycles—i.e., in the electric vehicle boom—bronze carries a persistent alloy premium over the tin scarcity premium.

Process Complexity and Value Added

These process differences in complexity and value addition significantly influence the prices of bronze and pure copper. Here we are going to explain in minute detail how these differences influence their prices specifically with reference to their requirements for casting, ease or difficulty in processing, and artistic and historical values they carry.

Casting Requirements

Bronze, tin bronze especially, is generally employed in casting intricate shapes because it has good fluidity when casted. Yet the expense of actual casting, i.e., the molds, melt control, and further processing, is significantly higher than in rolling or drawing to obtain pure copper.

Processing Difficulty

Bronze is harder than the pure copper and has wear resistance. Thus, machining operations like cutting, milling, and drilling tend to result in greater tool wear, which reduces the processing rate and consequently increases the production cost.

Artistic and Historical Value

In the world of art, antiques, and musical instruments—especially cymbals and bells—bronze has an exceptional artistic, cultural, and collectible value, due to its unique color, resonant quality when struck, and long history. Its value is well beyond the material cost, making the price considerably higher than that of an equal weight of pure copper.

The Influence of Market Supply and Demand Dynamics

Then, we will examine the price movements and effects of pure copper and bronze in terms of market demand and supply relationship.

Pure copper

The world's third most used metal after iron and aluminum, has its supply and demand inextricably linked to the beat of industrialization and the zeal of the energy transition. Three main forces drive this metal's demand: power infrastructure, such as power grids and wiring harnesses for new energy vehicles, and building piping and industrial equipment. Not only are its uses varied, but they are also extensive, reaching into power generation, construction, transportation, and home appliances. Its price also serves as a barometer of the The world's macroeconomy, particularly in the manufacturing industry, where the ebb and flow of supply and demand follow a relatively predictable trajectory.

Bronze

Demand is focused in certain industrial applications, for example, bearings, wear-resistant components, ships, and specialized consumer products, for instance, artwork and musical instruments. Some specialty or high-end bronzes, like beryllium bronze and aluminum bronze, can have smaller markets and more specialized supply channels, leading to higher price volatility caused by supply and demand imbalances in particular market segments. A dramatic increase in demand for specialty bronzes in a particular downstream industry, for instance, wind power or new energy, can substantially push its price up in a particular time.

When Might Pure Copper Potentially Be More Expensive? - Understanding The Benchmark

The relativity of "expensive": Any discussion of "expensive" requires a clear benchmark. This can be per unit weight, per unit volume, per particular function, or per end product. A benchmark is a necessary part of any comparison. Without a definite parameter of comparison, the term "expensive" becomes meaningless. In terms of a particular point of view, pure copper can actually be more expensive than bronze.

Functional Cost Considerations

Though bronze ingots are usually 20-50% more expensive per ton than copper, the situation is reversed when comparisons are made with specialty copper ingot shapes. For uses demanding ultimate conductivity, like ultra-high voltage cable cores and electronic components of the highest grade, very high-purity oxygen-free copper is the sole choice. Its purified quality and specialty processing can result in its unit cost being more than that of certain standard bronze types, specifically low-tin bronze.

Bulk Purchasing vs. Small-Batch Customization

Pure copper ingots or rods, which are traded as bulk commodities, generally offer the lowest price per weight. In contrast, small-batch customizations, specific specifications, or non-standard alloy compositions can markedly elevate unit costs, owing to the production flexibility required and the minimum order quantities involved.

Form Differences: It does not make much sense to compare the price of heavy bronze ingots and pure copper foil. Both must be compared at the same level, i.e., comparing market prices for the same or analogous forms, e.g., plates and bars.

FAQs

1. Since bronze is more expensive, why not use pure copper?

Due to the fact that pure copper is too soft, wears poorly, and is lacking in strength. So, bronze is used in most of the industrial applications. Bronze serves an indispensable function where high strength, wear resistance, corrosion resistance, particularly in sea water, good cast ability, and certain anti-friction qualities, or in bearings, are needed. Pure copper has its merits in electrical and thermal conductivity and ductility.

2. Are all bronzes more expensive than copper? Are there cheaper bronzes?

In general, bronze costs more than pure copper. Nevertheless, "bronze" with a very low tin content or with admixture of cheap elements, like lead bronze with high lead content, can be close to or even slightly below the price of pure copper of the same era. But its properties and applications are quite different, and it is not usually regarded as a common bronze. Conventional tin bronze with over 5% tin content is certainly more costly.

3. Why are antique bronzes so expensive? Is it the material itself?

Not due to material. The main reason it is so expensive is not the intrinsic value of bronze, even though it plays a tiny part. Instead, its unmatched historical, artistic, rare, and collectible value are the main causes of its high cost. For instance, the material value of antique bronze only constitutes a very minute amount of its overall value, so the cost isn't entirely because of the material.

4. Which is more costly, bronze or brass?

Comparing the two requires a specific analysis. Brass is a copper-zinc alloy. When comparing brass and bronze, you need to consider the specific grade and form. Generally, tin bronze is more expensive than ordinary brass, such as copper-zinc alloys, because tin is much more expensive than zinc. However, when comparing the prices of specialized brasses, such as high-strength complex brass or specialized bronzes like aluminum bronze, it's necessary to analyze market quotes.

Summary

Practice has shown that bronze, because of the high cost of tin and its complicated production process, tends to be more costly than pure copper. However, the cost difference is quite variable with respect to alloy composition, market, and use. Overall, industrial choice involves going beyond theoretical considerations and finding the cost-performance compromise in practical situations in order to make the best choice.

Don't spend time on trial and error! LS experts use a database of more than 200 industrial projects and dynamic simulations of the global metal supply chain to tailor the best solution to you. Get in touch with us today to enable cost certainty for your decision!

In the face of these higher challenges, LS's CNC turning service is your indispensable ultimate "tool". It represents industrial-grade precision, unparalleled repeatability and efficient productivity, allowing your design ideas to be perfectly, consistently and efficiently realized. Choosing LS is to inject industrial-grade precision power into your extraordinary craftsmanship.

Upload your design drawings now and get an instant CNC turning quote (cnc turning price), let LS be your strong backing in pursuit of ultimate woodworking precision!

📞Tel: +86 185 6675 9667

📧Email: info@longshengmfg.com

🌐Website:https://lsrpf.com/

Disclaimer

The contents of this page are for informational purposes only.LS seriesThere are no representations or warranties, express or implied, as to the accuracy, completeness or validity of the information. It should not be inferred that a third-party supplier or manufacturer will provide performance parameters, geometric tolerances, specific design characteristics, material quality and type or workmanship through the LS network. It's the buyer's responsibilityRequire parts quotationIdentify specific requirements for these sections.Please contact us for more information.

LS Team

LS is an industry-leading companyFocus on custom manufacturing solutions. We have over 20 years of experience with over 5,000 customers, and we focus on high precisionCNC machining,Sheet metal manufacturing,3D printing,Injection molding,Metal stamping,and other one-stop manufacturing services.

Our factory is equipped with over 100 state-of-the-art 5-axis machining centers, ISO 9001:2015 certified. We provide fast, efficient and high-quality manufacturing solutions to customers in more than 150 countries around the world. Whether it is small volume production or large-scale customization, we can meet your needs with the fastest delivery within 24 hours. chooseLS technologyThis means selection efficiency, quality and professionalism.

To learn more, visit our website:www.lsrpf.com